Updated on March 10, 2024

October 30, 2023

Windsor Brokers. Another of the brokerage companies that certainly deserves your attention. This brand presents itself to traders primarily as an expert in social trading. And specifically on Copy Trading. At the same time, it presents itself as a trustworthy broker, which is reliable, safe, and moreover promises rewards to its loyal clients. But what is it really like to trade with Windsor Brokers? That’s what we’ll look at in this review.

Review Windsor Brokers quickly and clearly

Windsor Brokers is a regulated brokerage brand with a long tradition. It offers its clients an entry bonus of $30 under certain conditions and gives them a choice of several types of accounts, including a free demo account. The educational opportunities here are excellent. Here you will find many opportunities to learn something new from the world of trading. However, if we look at the services offered by this broker, they are rather average. The number of assets offered is below average compared to other brands.

The essentials about Windsor Brokers

Windsor Brokers is a global online broker that allows its clients to trade CFD products. It is a trusted brand whose history dates back to 1988. Currently, you can use its services through the WindsorBrokers.com website.

Services to clients originating from the European Union are provided at this address by Windsor Brokers Ltd, based in the Cyprus city of Limassol. And it was from the Cyprus CySEC ( Cyprus Securities and Exchange Commission ) that this company received a license that entitles it to offer its services not only in Cyprus, but within the entire EU. And therefore also in the Czech Republic.

What the broker will offer you

When we say that Windsor Brokers is a CFD broker, it surely tells you that you can trade CFD products with them. So only financial derivatives, not physical assets. Classic shares and ETFs included. So if you are looking for a broker with whom you can trade classic securities, then Windsor Brokers is probably not what you are looking for. But if CFDs are enough for you, then this broker might be the right one for you.

CFD trading

If you’re confused about what CFD trading actually entails, let’s explain it in a nutshell. When you choose to trade CFD products, you are not trading physical assets. So you won’t actually buy a ton of oil. Or, on the contrary, they sold it. This is only speculation on the price level of the underlying asset. So when you enter a buy position, then you are speculating on its growth. On the other hand, when you enter a sell position, you let the broker know that you are speculating on its decline.

Whether you will make a profit from your trade, or whether you will lose in it, will depend on whether you have correctly estimated the price development of the given asset. The moment you enter the trade, you enter into an imaginary agreement with the broker that you both agree to pay the other party any price difference. If the price has moved in the direction you expected from the time you entered the trade to the time you exited your position, the broker will pay you the difference. And you will earn from it. But if it moves above the other side, then you pay the difference to the broker. And of course you will lose.

You can also make good money trading financial derivatives. That is, if you can correctly estimate in which direction the price of the given asset will move based on the findings from the market research. In addition, there are several pluses that you will not find when trading traditional assets. First of all, it is precisely the fact that you do not have to deal with the transport and storage of commodities. And then also the fact that you can earn not only on the growth, but also on the decline in the price of the asset.

Financial leverage

CFD trading also inherently includes the possibility of using financial leverage. What is it? It is a mechanism that allows you to trade with a larger volume of a certain asset than you have funded yourself. And that with several times bigger. But you should know that using financial leverage can be quite risky, especially for beginning traders.

This is because when you use this mechanism for your store, your earnings will multiply, as well as the profit you generated on the store. So, on the one hand, you can take it as a big advantage. On the other hand, you can quickly lose your finances. Therefore, we recommend that you first familiarize yourself with the functioning of the market and the possible risks.

On the market, you will meet a number of unregulated brokers who will offer you the opportunity to use really high financial leverage. And it can carry a really high risk for you. Especially if you don’t have enough trading experience yet. However, this does not apply to the Windsor Brokers brand. It respects the regulations of the ESMA (European Securities and Markets Authority) and has set the maximum possible amount for retail traders as follows:

- Up to 1.30am for major currency pairs

- Up to 1:20 for minor currency pairs, major indices and gold

- Up to 1:10 for secondary indices and other commodities

- Up to 1:5 for stocks, ETFs and bonds

- Up to 1:2 for cryptocurrencies

But professional traders are a different category. They can count on a leverage of up to 1:500 with this brokerage brand.

Offer assets to trade

So now you know what kind of trading awaits you with this broker. But it remains to introduce the specific assets that you can trade at Windsor Brokers. So what are they? These include stocks, ETFs, bonds , Forex currency pairs, indices, commodities and cryptocurrencies.

We can therefore say that the offer of CFD products at Windsor Brokers is quite wide. But what about the number of a specific asset class? That’s what we’re going to take a closer look at now.

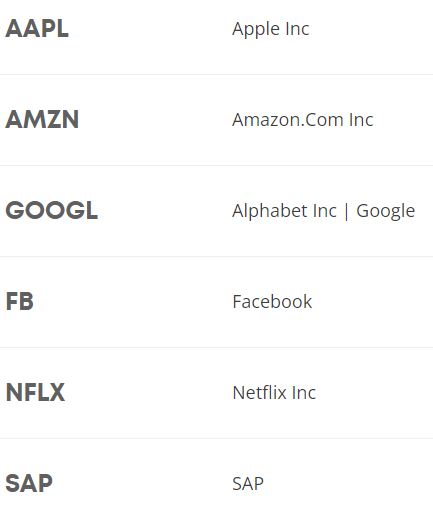

Stocks

Of the shares, this broker will offer you only American ones. More specifically, those from the US. You can trade a total of 104 of them here. However, you will not find securities from European countries with this brand.

ETFs

There are a total of 6 baskets of stocks, i.e. ETFs, to choose from at Windsor Brokers. So there is no big selection in this area.

Bonds

If you would also like to trade bonds as a CFD, this broker will allow you to do so. And this is not at all a matter of course with CFD brokers. In total, he will offer you 4 of these securities. And in addition to US bonds, you also have European bonds available. More specifically, those from Germany.

Forex

Windsor Brokers will also make available to you trading in the foreign exchange market where currency pairs are traded. You will find a total of 45 of these at this company. Among them are main and cross pairs. Not the exotic ones though.

Indexes

There are a total of 14 indices that this broker will offer you. And it’s not just the American ones. Among them are also those from European countries, Australia or Asia. Specifically, you can trade here, for example, Dow Jones, EU 50 or Japan 225.

Commodities

In terms of commodities, Windsor Brokers offers agricultural, metal and energy commodities to choose from. You can choose from 13 different commodities. Among them, of course, there is no shortage of gold, oil or corn

Cryptocurrencies

The selection of virtual currency for trading is not very wide for this brand. This broker gives you a choice between 6 cryptocurrencies.

How to trade with Windsor Brokers

MetaTrader 4

The brokerage brand Windsor Brokers lets its traders trade through the MetaTrader 4 trading platform. No other platform is available with this broker. Which of course brings a disadvantage if this platform does not suit you and you would like to use another. On the other hand, it is currently the most popular trading platform on the market. You can find it in the offer of most current brokers.

MT4 is supposed to suit not only novice traders but also more advanced ones. The MT4 platform is intuitive, so you can become friends with it quite easily. In addition, it contains a number of functions and advanced tools that can be used by more demanding traders.

Another advantage is that you can use it in different ways. And it’s up to you whether you use all three or choose the only option that suits you. You can open it as a WebTrader in your browser window. You can log in from any device you have at hand. But if you don’t mind downloading apps and would prefer a more stable version, you can download the desktop platform to your computer.

And the third option, which will certainly be welcomed by all who want to have an overview of their trading in any situation, is the mobile application. You can download it to your phone via the App Store or Google Play.

Mobile application and loyalty program

Windsor Brokers also has its own mobile application with which you can track your trades. Or trade. At the same time, you can monitor how you are doing within the loyalty program that the broker has prepared for its clients. It consists of four levels, depending on the volume of your trades. The more volume you trade, the higher level you are. You can then redeem your accumulated points for rewards.

The Windsor Brokers mobile application can be downloaded to a phone with the Android or IOS operating system.

Copy Trading

What the Windor Brokers brand emphasizes already in its own introduction to traders is Copy Trading . The point is that if you don’t believe in yourself enough as a trader, you can rely on successful traders and copy their steps. Just register and choose a merchant you trust.

You can then adjust the terms to suit you. This means that you can, for example, adjust the size of individual trades or set certain rules. Subsequently, all you have to do is press the “Activate” button and the strategies of the selected trader will be automatically copied to your trading account.

But Copy Trading is an opportunity not only for novice traders or for those who simply do not have time to constantly research the market. Even more experienced traders who believe in themselves enough to share their trading strategies with other traders can be realized here. And if they are successful, they can receive varying amounts of compensation.

How to open an account with Windsor Brokers

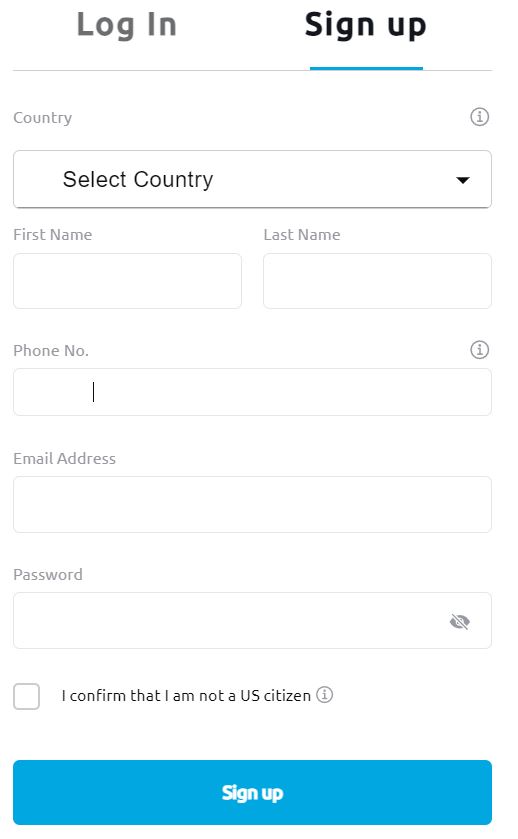

Anyone can open an account with Windsor Brokers. It’s quick, easy and you can easily do it online. Either a phone or a computer will be enough for you. As well as all trading with this broker. First, you need to open the broker’s website and click the “Open Account” button in the upper right corner. There is also a “Try Demo” button right next to it, which you can click if you decide to open a practice account first.

Registration

In order to open a demo account or any of the live accounts, you must first register with the broker. Registration involves only filling in a short questionnaire where you fill in your name, surname and contact information. To do this, you will also determine the password with which you will log in to your account. Then all you have to do is verify your contact details and your registration is complete.

You will then be prompted to select the account you have chosen. And also choosing the currency in which you want to keep your account. You can choose between USD, GBP, EUR and JPY. So don’t count on the Czech currency here. Therefore, keep in mind that you may also be subject to a currency conversion fee.

Demo account

A demo account is a practice account that you can open today for free with most online brokers. This is for the purpose of training your own trading strategies or getting to know the broker and its trading platform. The Windsor Brokers brand is no different. However, for this you must first register, and when choosing the type of account you want to create, you choose a Demo account.

You can open a maximum of two demo accounts this way. But you can use them as long as you want. The broker did not set any time limit here. After creating a practice account, the broker will credit it with a certain amount – only virtual, of course. And then you will be able to use this for your practice trades.

Live accounts

If you wish to open a live account, you choose the type of live account you want to open after registration. After that, other questionnaires will follow, where the broker will be interested in additional information about you. Among them also your place of residence, social security number or source of your income. After filling them in, also expect that your account needs to be verified. So verify. It’s nothing special. This procedure is typical for brokers. And that’s because that’s how they respect anti-money laundering laws.

So what will you need for this step? Scans or photos of two documents. The broker verifies your identity with the first one. This can be done with your ID card, driver’s license or valid passport. And then he will need a document to verify your residence. You can provide it by uploading a utility bill or a statement from your bank account.

Pay attention to the fact that the account is verified only when the broker confirms it to you. So it may take some time. By verifying your account, you can start using it to its fullest. Until then, it is not possible to withdraw funds from your trading account. Therefore, we recommend making the first deposit only after the verification is complete.

Types of live accounts

With this brand, you can choose between 3 types of live accounts. These include Zero, Prime and VIP Zero accounts. We will compare the first two mentioned accounts in the following table. So Zero and Prime.

| Zero | Prime | |

| Minimum deposit | 1000 USD | 50 USD |

| Spread from | From 0 pip | From 1.0 pip |

| Commission | $8 per action | No commission |

| Islamic account available | No | Yes |

| Provision of training | No | Yes |

A VIP Zero account is also available here for Zero account holders. And for those who have a high fortune. With this account, you get additional benefits, including a personal Account Manager and one-on-one meetings with experienced technical analysts from the Windsor Brokers team.

Deposits and Withdrawals at Windsor Brokers

You can make deposits and withdrawals at Windsor Broker in three ways. By bank transfer, payment card or electronic wallets. However, in any case, your account, card or wallet must be in your name, the broker does not accept payments or send them to third-party accounts. At the same time, when choosing a payment method for a deposit, keep in mind that when choosing, the broker prefers the method you used for the deposit.

Deposits

Windsor Brokers does not charge any fees for deposits. At least in the case of payment card and bank transfer. However, you may be subject to fees in the case of deposits via internet wallets or international bank transfers.

The broker does not limit the minimum deposit. However, with the exception of the first deposit, where it is necessary to first deposit either 50 or 1000 USD. Depending on the type of account you choose. After that, the minimum deposit amount is no longer limited. But you have to look at the upper limit, when the deposit must not exceed the amount of 25,000.

Selections

However, withdrawals are already charged at Windsor Brokers. And that’s $3 for each withdrawal. However, if you withdraw via international bank transfer or electronic wallet, the amount of fees may vary. There is no minimum or maximum limit for withdrawals with this broker, so you can withdraw as much as you like – subject to fees.

Broker fees

And let’s also look at the fees you will pay at Windsor Brokers. We’ll start with the trading fees first, then we’ll cover the others.

Trading Fees

As we mentioned at the beginning, it is a CFD broker. So expect that one of the main fees is the spread. That is, the difference between the purchase and sale price of the asset. The amount of the spread is variable at Windsor Brokers, so this fee is not always the same. However, you should always check your trading platform for the current amount of this fee for each asset. Also take into account that the amount of the spread also depends on the type of account you have opened with the broker.

Another important fee for trading is also the commission fee, which the broker charges for mediating the trade. You could view its amount for individual accounts in the table. But we remind you that for the Zero account it is 8 USD per action. Windsor Brokers does not charge a commission fee for a Prime account.

And let’s also mention the swap fee. The broker will charge you if you decide to hold your trading position even after trading hours. However, with the Prime account, the broker also offers an Islamic version of the account without swaps.

Additional charges

Of the other fees, let’s once again remind you of the possible fees for deposits and withdrawals, which you can read about above. We will also add a mention of the inactivity fee, which the broker will deduct from you every 6 months when you leave your trading account inactive. The amount of this fee is $20.

In addition, you will likely be charged a currency conversion fee. This is charged by banks for the transfer of one currency to another in the event that you deposit funds into your trading account in a currency other than the one in which you keep it. The same also applies to withdrawals.

Customer service and education

Right at the beginning of this chapter, we must say that the Windsor Brokers brand does not support the Czech language. You can therefore read the website only in English, Spanish or another foreign language. And the same goes for communication with customer support and for education.

Customer service

The customer service of this broker is active around the clock. And that both on weekdays and weekends. You can contact him by phone, email or online chat. You can find it on the broker’s website. And it must be said that the support works quickly and willingly answers your questions.

Education

In the field of education, Windsor Brokers is not idle. A glossary, educational videos and e-books are available on his website, which are, however, only available to registered clients. As a trader, you even have the option to register for various webinars, which you can also watch retrospectively. But again, this offer is only valid for registered users.

You can also click through the broker’s website to the blog, where you can read educational articles or market analyses. And there are other tools available. For example, a forex calculator.

Safety

Every trader certainly has a legitimate fear of entrusting their finances to the right brokerage firm. But with the Windsor Brokers brand, this concern should be unnecessary. This is because it is a licensed broker that is subject to control by the Cyprus CySEC authority. And therefore they must follow European safety standards.

You can therefore rely on it to insure retail merchant accounts against negative balances. So you cannot go into the red on your trading account. This means that if you do not have funds in your account, the broker cannot even charge you an inactivity fee.

Additional security measures include that Windsor Brokers holds its clients’ funds in accounts and insures them against the failure of the broker. Up to EUR 20,000.

Experience with Windsor Brokers

However, the client reviews that we can find on the website may discourage us from doing business with this brand. They are mostly negative. Traders often complain that they have problems with withdrawals, that the broker has deleted their account without reason even with all the profits, and that customer support has stopped communicating with them in case of a problem. And these are serious issues that we would rather consider doing business with this company. In addition, there are also posts in which clients draw attention to the not-so-beneficial investment advice they received from their Account Manager.

Traders who have left a positive review mostly praise the fact that Windsor Brokers gave them a $30 welcome bonus for new customers. They also praise the functioning of the customer service as well as the low spreads.

Windsor Brokers Review – Summary

To sum up, Windsor Brokers is an online CFD broker that offers its services in various regions around the world. It is a regulated broker that offers new traders, under certain conditions, a bonus of USD 30, which they can use for their trading. The broker offers very good educational opportunities and fast customer support that works around the clock. In addition, it gives you a choice between several types of accounts, so you can choose exactly the one that suits you in terms of fees or the amount of the deposit.

But when we look at the asset offer, it is below average compared to other brokers. At least in terms of the number of individual types of CFD assets. On the other hand, it will also offer you CFDs on bonds for trading, which you will not find with most brokers.

But what worries us is the customer reviews that can be found on the website. In most cases, these are negative reviews in which clients complain about serious problems. Among them we can find problems with withdrawals or deletion of the entire trading account and earnings. In addition, according to these reviews, the broker and its customer support did not solve these problems in any way.